(A plan design strategy for plans using prior year testing)

All 401(k) plans are subject to annual discrimination testing (DT). There are two ways to prepare the DT: “current year” OR “prior year”. When current year is used, the DT test compares compensation and 401(k) contributions of highly compensated employees (HCEs) to those of nonhighly compensated employees (NHCEs) using data from the current year. When prior year is used, the DT compares compensation and 401(k) contributions of HCEs using data from the current year to compensation and 401(k) contributions of NHCEs using data from the prior year.

The discrimination testing passes if the average 401(k) contributions of HCEs is the lesser of 2 times or 2% more of the average 401(k) contributions of NHCEs.

When a plan uses prior year, rather than current year, to prepare the discrimination testing, the passing rate for HCEs is known early in the year. This gives a company more control over the results of their discrimination testing since they know the passing rate.

For example, if a plan uses prior year for discrimination testing and NHCEs had average 401(k) contributions of 3.22% of compensation in 2010, then HCEs could make average 401(k) contributions of up to 5.22% of compensation in 2011 and the discrimination testing would pass.

When a plan uses the prior year testing method, it knows early what the passing rate is, but that does not guarantee the HCEs are going to comply with the passing rate. If all HCEs in our example above made 401(k) contributions of 6% of compensation, the DT would fail. When a plan fails the discrimination testing, corrective action is required.

There are two ways to correct a discrimination testing failure: give refunds to HCEs to bring their 401(k) percentage down, or give employer contributions to NHCEs to bring their 401(k) percentage up. If refunds are processed, refunds are allocated among HCEs based on the dollar amount of their 401(k) contribution, not their percentage. The result is that the 401(k) contributions of all HCEs are reduced to the same dollar amount.

For example, all HCEs 401(k) contributions may be refunded down to a 401(k) amount of $10,000. Any HCE with 401(k) contributions above that dollar amount would get a refund so their remaining 401(k) contribution in the plan was only $10,000. On a dollar basis, this is fair. This is how the 401(k) corrective refunds are designed. However, on a percentage of compensation basis, this is unfair. The HCEs will end up with different percentages of compensation contributed. The higher paid HCEs will end up with a lower percentage of their compensation as 401(k) contributions in the plan after the corrective refund.

Consider, for example, two HCEs, one with compensation of $112,000 and one with compensation of $245,000. When each is left with 401(k) contributions of $10,000 the HCE with compensation of $112,000 has a 401(k) percentage of compensation of 8.93%. The HCE with compensation of $245,000 has a 401(k) percentage of compensation of 4.08%. This is not fair on a percentage basis.

There is a way to make sure all HCEs are all allowed to make 401(k) contributions of at least the same percentage of compensation if the plan uses the prior year testing method.

The plan document can be amended each year to identify the maximum 401(k) contribution that HCEs can make. In the example below, the plan document would be amended to identify that for the 2011 plan year HCEs can make 401(k) contributions of up to 5.22% of compensation. This will ensure the plan passes the discrimination testing. This will also ensure that all HCEs, regardless of their compensation, can make 401(k) contributions of at least 5.22% of compensation. This is more fair on a percentage of compensation basis.

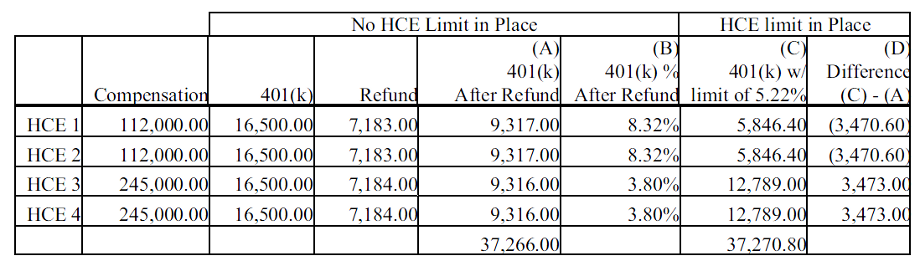

Below is a visual example. In this example, the passing 401(k) percentage for HCEs is 5.22% of compensation. If the plan does not limit the 401(k) contributions of HCEs and all HCEs make the maximum 401(k) contribution of $16,500 the test fails with an HCE average 401(k) percentage of 10.73%. After refunds, each HCE has 401(k) contributions of a level dollar amount, $9,317.00 that remains in the plan (Column A). This is not fair on a percentage of compensation basis as some HCEs would have a higher contribution percentage than others (Column B). If the plan were to limit the 401(k) contributions of HCEs to 5.22% of compensation (Column C), the test would pass and all employees would be able to contribute the same percentage of compensation into the plan plus catch up contributions. Catch up contributions are available to participants that have attained the age of 50. The effect is that the higher paid employees are able to make 401(k) contributions of at least the passing percentage, which ultimately allows them to have 401(k) contributions of a greater amount than if they did not limit the 401(k) contributions of HCEs (Column D).

To discuss this or any other plan design questions you may have or to make this change to your plan, contact Administrative Retirement Services, Inc.